Robinhood Financial: The Commission-Free Trading App Taking the Financial World by Storm

|

| A chart with rapidly fluctuating lines and arrowrs, representing short-erm trading and potential risk |

The Robinhood Revolution: Democratizing the Stock Market

The financial landscape has undergone a seismic shift in recent years, reshaping how both millennials and seasoned investors engage with the stock market. At the forefront of this transformation stands Robinhood Financial, the commission-free trading app that has taken the financial world by storm.

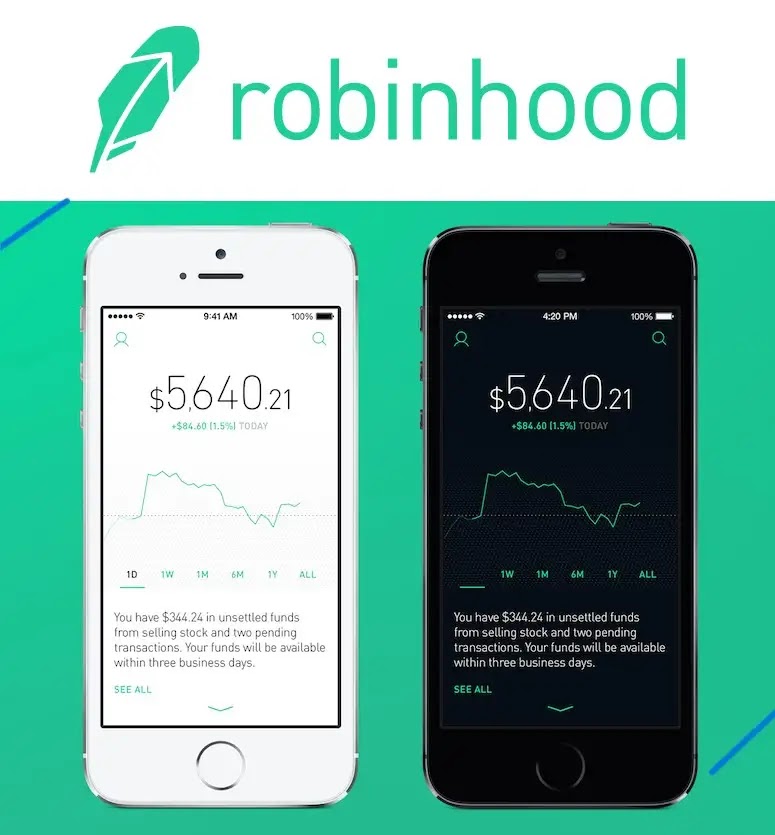

Robinhood's sleek interface, user-friendly functionality, and commitment to making stock market access more democratic have quickly propelled it to become the go-to platform for a new generation of traders. Founded in 2013, Robinhood has not only streamlined the investment process but also shattered traditional barriers to entry, making it possible for anyone with a smartphone to invest in stocks without the burden of hefty transaction fees.

As we delve deeper into the workings, features, and impact of this groundbreaking app, it becomes evident that Robinhood is more than just a company; it's a financial revolution with staying power.

Robinhood Financial: The Commission-Free Trading App Taking the Financial World by Storm

**Robinhood Financial has become a household name in the financial world, shaking up the industry with its innovative, commission-free trading app. Launched in 2013, Robinhood has quickly gained millions of users, particularly younger investors attracted to its user-friendly interface and low fees. But is Robinhood all it's cracked up to be? Is it a safe and reliable platform for your investments?**

**What is Robinhood?**

Robinhood is a mobile app and web platform that allows users to buy and sell stocks, ETFs, options, and cryptocurrency commission-free. It also offers fractional shares, allowing users to invest in expensive stocks with as little as a few dollars.

**Key Features:**

- * **Commission-free trading:** This is the most attractive feature of Robinhood, making it a popular choice for new and casual investors.

- * **Fractional shares:** This allows you to invest in expensive stocks like Amazon (AMZN) or Google (GOOG) with a small amount of money.

- * **User-friendly interface:** The Robinhood app is simple and intuitive, making it easy for even non-financial experts to get started.

- * **Investment research:** Robinhood provides some basic investment research tools, such as stock charts and news articles.

- * **Cryptocurrency trading:** Robinhood allows you to buy and sell Bitcoin, Ethereum, and other popular cryptocurrencies.

**Benefits of Robinhood:**

- * **Low cost:** The lack of commissions makes Robinhood a very affordable option for investors.

- * **Accessibility:** Robinhood makes investing more accessible to everyone, regardless of their income level or financial background.

- * **Convenience:** The mobile app makes it easy to trade from anywhere, at any time.

- * **Fractional shares:** This feature allows you to diversify your portfolio and invest in expensive stocks with a small amount of money.

- * **Cryptocurrency trading:** Robinhood is one of the few mainstream platforms that offer cryptocurrency trading.

**Drawbacks of Robinhood:**

- * **Limited investment options:** Robinhood only offers stocks, ETFs, options, and cryptocurrency. You cannot invest in mutual funds, bonds, or other assets.

- * **Minimal research tools:** Robinhood provides basic research tools, but they are not as comprehensive as what you would find on other platforms.

- * **Focus on short-term trading:** Robinhood's features and marketing seem to be geared towards short-term trading, which can be risky.

- * **Frequent outages and glitches:** Robinhood has experienced several outages and glitches in the past, which can be frustrating for users.

- * **Customer service concerns:** Some users have reported difficulties getting help from Robinhood's customer service team.

**Is Robinhood Right for You?**

Robinhood can be a great platform for new investors who are looking for a simple and affordable way to get started. However, it's important to be aware of the limitations of the platform before you invest any money. If you're looking for a more comprehensive investment platform with more research tools and investment options, you may want to consider a traditional brokerage firm.

**Final Thoughts:**

Robinhood has revolutionized the way we invest by making it more accessible and affordable for everyone. However, it's important to be aware of the platform's limitations before you invest any money. If you're a new investor, Robinhood can be a great place to learn the ropes. But if you're a more experienced investor, you may want to consider a different platform.

**Additional Resources:**

- * Robinhood website: [https://robinhood.com/](https://robinhood.com/)

- * Robinhood Investor Relations: [https://investors.robinhood.com/overview/default.aspx]

- * Robinhood Help Center: [https://robinhood.com/us/en/support/]

- **Keywords:** Robinhood, commission-free trading, investing, app, stock market, cryptocurrency, finance

- **Beyond the Hype: A Detailed Look at Robinhood's Pros and Cons:** While Robinhood has undoubtedly disrupted the traditional brokerage model, its appeal goes beyond just commission-free trading. Let's delve deeper into its features and user experience, addressing both its strengths and weaknesses to help you decide if it's the right platform for your investing goals.

Robinhood: Unveiling the Strengths and Weaknesses

**Robinhood has rapidly gained popularity, particularly among young investors, due to its user-friendly interface and commission-free trading. Let's delve deeper into its strengths and weaknesses to help you determine if it's the right platform for your investment journey.**

**Strengths:**

- * **Fractional Shares:** Invest in even the most expensive stocks, like Apple (AAPL) or Tesla (TSLA), with a small amount of money. This democratizes access to previously out-of-reach investments and facilitates portfolio diversification.

- * **Cryptocurrency Trading:** Buy and sell popular cryptocurrencies like Bitcoin and Ethereum directly within the app, simplifying the process for investors who want exposure to this emerging asset class.

- * **Educational Resources:** Learn about investing basics and market trends through access to educational articles and videos within the app. While not a comprehensive substitute for financial advice, these resources can be invaluable for new investors.

- * **Democratizing Investing:** Robinhood has lowered the barrier to entry for investing by eliminating commissions and offering fractional shares. This allows anyone, regardless of their financial background, to participate in the stock market and build wealth over time.

- * **Intuitive Mobile App:** The Robinhood app is user-friendly and visually appealing, making it easy to navigate and execute trades. Its sleek design and gamification elements encourage user engagement.

**Weaknesses:**

- * **Limited Investment Options:** Diversification opportunities are limited due to a lack of access to various asset classes like mutual funds, bonds, and commodities.

- * **Limited Research Tools:** Conducting in-depth analysis can be challenging due to insufficient built-in research tools. Experienced investors may need to rely on external resources.

- * **Focus on Short-Term Trading:** Features and marketing seem geared towards short-term trading, which can be risky and lead to impulsive decisions. This approach may not be suitable for long-term investors.

- * **Outages and Glitches:** Past outages and technical glitches raise concerns about the platform's reliability, especially during market volatility.

- * **Customer Service Issues:** Difficulties getting help from customer service can be a major concern, especially for investors who need assistance.

- * **Limited Investment Options:** Robinhood's limited offering of investment options, primarily focusing on stocks, ETFs, options, and cryptocurrency.

Comments

Post a Comment